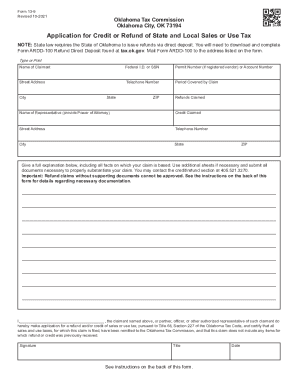

OK Form 13-9 2022-2025 free printable template

Show details

This document serves as an application for individuals or businesses to request a credit or refund of state and local sales or use tax paid to the Oklahoma Tax Commission.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ok 13 9 state sales form

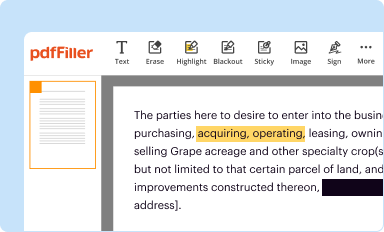

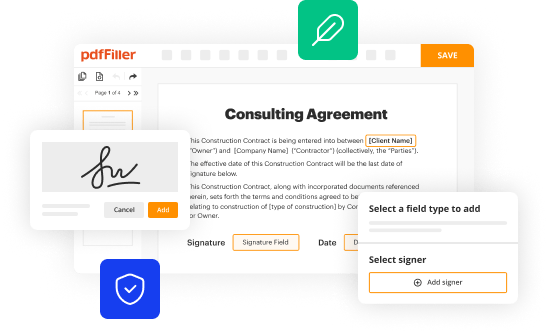

Edit your 13 9 credit refund form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

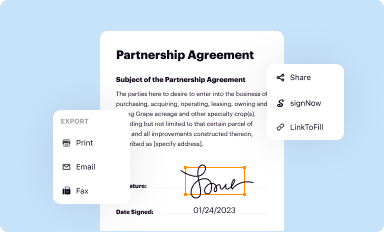

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ok form 13 sales use pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 13 9 credit local use form online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ok form 13 9 refund sales use. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK Form 13-9 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ok 13 9 refund sales use tax form

How to fill out OK Form 13-9

01

Obtain a copy of the OK Form 13-9 from your supervisor or the official website.

02

Fill in your personal information in the designated sections, including name, address, and contact details.

03

Provide the date and location of the request in the appropriate fields.

04

Clearly describe the purpose for submitting the OK Form 13-9 in the narrative section.

05

Attach any required supporting documents relevant to the form request.

06

Review the completed form for accuracy and completeness.

07

Submit the form to the designated office or supervisor as instructed.

Who needs OK Form 13-9?

01

The OK Form 13-9 is typically needed by individuals seeking approval for specific requests within governmental or organizational procedures.

Fill

ok 13 9 refund tax download

: Try Risk Free

People Also Ask about oklahoma 13 9 use download

How do I qualify for sales tax credit in Oklahoma?

Sales Tax Relief Credit You must be an Oklahoma resident for the entire year and your total gross household income cannot exceed $20,000 unless: You can claim an exemption for your dependent. You are 65 years of age or older by 12/31/2022. You have a physical disability (handicap to employment)

Can a business refuse tax-exempt in Oklahoma?

A vendor who willfully or intentionally refuses to honor the sales tax exemption affordeda 100% disabled veteran's or the unremarried surviving spouse of a deceased qualifying disabled veteran is subject to punishment by an administrative fine for the first offense.

How do I qualify for farm tax exemption in Oklahoma?

How do I apply for an Agricultural Exemption Permit? When listing your farm equipment with the County Assessor between January 1st - March 15th of each year, the County Assessor will fill out an Agricultural Exemption Permit form provided by the Oklahoma Tax Commission.

What is the small seller exemption in Oklahoma?

What is the small seller exception? Oklahoma has a small seller exception, which exempts a remote seller from reporting or remitting taxes for sales into Oklahoma.

How do I claim my Oklahoma sales tax refund?

You may contact the credit/refund section at (405) 521-3270. Important: Refund claims without supporting documents cannot be approved. See the instructions on the back of this form for details regarding necessary documentation. NOTE: State law requires the State of Oklahoma to issue refunds via direct deposit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete ok 13 9 application get online?

With pdfFiller, you may easily complete and sign ok 13 9 local sales sample online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make changes in ok 13 9 state sales fill?

With pdfFiller, it's easy to make changes. Open your oklahoma refund local use tax in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How can I fill out oklahoma 13 9 credit refund use on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your oklahoma 13 use form. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

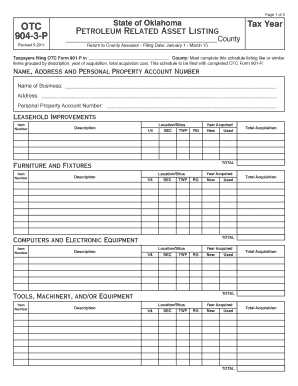

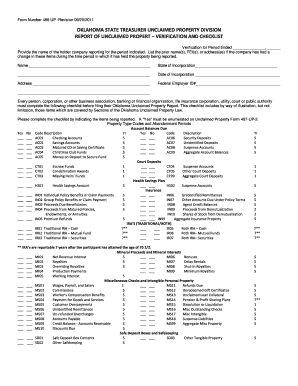

What is OK Form 13-9?

OK Form 13-9 is a document used by taxpayers in Oklahoma to report certain financial information as part of their tax obligations.

Who is required to file OK Form 13-9?

Individuals and entities that meet specific criteria set by the Oklahoma Tax Commission, typically involving income thresholds or business activities, are required to file OK Form 13-9.

How to fill out OK Form 13-9?

To fill out OK Form 13-9, you need to provide personal and business information, report income, and calculate the applicable tax, ensuring that all required sections are completed accurately.

What is the purpose of OK Form 13-9?

The purpose of OK Form 13-9 is to collect information necessary for the calculation of state taxes, helping ensure compliance with Oklahoma tax laws.

What information must be reported on OK Form 13-9?

OK Form 13-9 requires reporting of personal identification details, income sources, deductions, and any applicable credits as per the state tax guidelines.

Fill out your OK Form 13-9 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

13 9 Local Sales Fill is not the form you're looking for?Search for another form here.

Keywords relevant to oklahoma credit state sales use

Related to oklahoma refund local search

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.